It’s a little long, but well worth it. It comes from my friend John Thomas, The Mad Hedge Fund Trader. And even though we have our problems here, where else would you really want to live?

The Declining America Myth.

It seems that it has become fashionable to bash America these days. As I run around the country giving my strategy luncheons, I hear a lament that has become all too familiar.

America has peaked as a civilization, the story goes, and will follow the British, French, Roman, and even the Egyptian empires into the dustbin of history. Our standard of living is falling, our technological prowess is fading, and our military strength is weakening. It will be just another generation before the Chinese take over the world and we will all be forced to learn Mandarin in high school, or somebody worse will take their place.

Such bouts of doubt, angst, and self-loathing occur every generation in America. I received a big dose after the US withdrew from Vietnam in 1972. My dad felt the same after Pearl Harbor was attacked in 1941. So did my grandfather when the Lusitania was sunk in 1917. The outbreak of the Civil War in 1861 was considered the country’s darkest day. And then there was the British burning of Washington in 1812. I remember it like it was yesterday.

I say horse feathers, bull-puckey, and balderdash to all this talk. When speaking to foreign governments, military leaders, and central bankers during my global travels I keep hearing a recurring theme. The United States is still the great shining example up on the hill. We are dominant in technology and increasing at an accelerating rate. All I hear about are our country’s strengths.

Our economy can evolve faster than anywhere else on the planet. This is because no one can beat us at creative destruction. Some 22 years into Japan’s stock market crash they are still maintaining companies on life support at enormous expense. We cleansed our system in about six months. And try downsizing outdated unions in Germany. We have cut the union share of labor from 35% to 15% in 30 years. Where else can someone with no money but good ideas become a billionaire in a couple of years?

Since I am a numbers guy, let me throw a few out there just to make my case. With a $15 trillion GDP, ours is triple contenders number two and three at $5 trillion, China and Japan. We are nearly four times Germany’s size at $4 trillion. Our per capita GDP is a staggering twelve times China’s. That means it takes 12 Chinese workers to produce an hour of output compared to our one. This is why America’s per capital income stands at $47,200, compared to only $4,260 in the Middle Kingdom, and many Chinese have to work a 70 hour week to take this home. They are supposed to be overtaking us? Even the Chinese laugh when I tell them this.

Some 18 of the world’s 50 largest companies are still US based, like Exxon (XOM), Wal-Mart (WMT), Apple (AAPL), and Boeing (BA). But this understates the true picture. Ours occupy far and away the highest end of the value added chain. Many of the rest scrape by copying or pirating our products. You never get ahead that way. Look no further than Apple, which pays workers a minimal $15/day to build US designed products for sale at home with enormous profit margins.

It’s hard to find a strategic industry that we don’t dominate. US companies invented “fracking” which has untapped vast new energy supplies, making the Middle East irrelevant. Saudi princes come here for their health care, not England or Japan. “Globalization” has in fact become the polite word for “Americanization”.

I was standing at Piccadilly Circus in London the other day when a bus stopped and unloaded 50 gorgeous high school girls. I couldn’t for the life of me figure out their nationality. They could have come from anywhere. The teacher had a big butt, so I though maybe American. Then a kid lit up a cigarette and no one cared. Aha! French. They turned out to be the winners of a national English language essay-writing contest and the prize was a trip to the Olympics.

Let me just toss a few more tidbits out there:

*The biggest selling luxury car in China is a GM (GM) Buick

* iPhones, Ford Mustangs, and Katy Perry songs are pouring into a newly freed Libya.

*Cubans and Iranians are erecting illegal satellite dishes so they can watch Law and Order

*Travel around Eastern Europe and all you see are blue jeans

*Over 70% of the drinkers of Coca-Cola are outside the US

*McDonald’s (MCD) has 10,000 hamburger stands abroad

*Microsoft’s (MSFT) Windows operating system runs 90% of the world’s computers

*London has 19,000 people a month joining Match.com

While the US has run big trade deficits for 50 years, we have a perennial surplus in services that goes unnoticed. We remain the force to reckon with in banking and finance, thanks to the reserve currency status of our dollar. Transfer dollars from the UK to Japan and it has to go through New York. This isn’t changing in my lifetime. The world’s wealthy and well connected have long sent their kids to American universities. Six out of ten of the world’s best schools are here, matched only by Oxford, Cambridge, Tokyo University, and Beijing University.

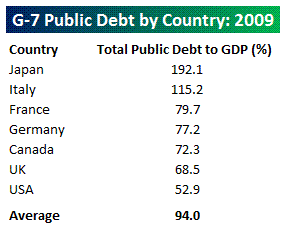

You may be concerned about our rising level of national debt. Aren’t we under saving and over spending? The credit markets beg to differ with you. With 30-year Treasury bond rates at 2.55%, the world is literally throwing money at us as fast as they can. With the long-term inflation rate probably at 3%, this means that our government can borrow money for free!

Foreign individuals and institutions regularly take down more than half of our monthly government debt issues. With Europe in trouble, this trend is accelerating. The government’s error is not that it’s borrowing too much money, but not enough. Prices tell us that there is a severe shortage of US bonds. We could probably double the national debt from here without much impact on interest rates. Apparently, the free marketers don’t look at markets very often.

You have heard me talk a lot about demographics over the years. The US still has a modestly positive slope to its demographic pyramid, which is the best in the developed world. This means that we can expect an ever larger number of young consumers to drive economic growth, largely driven by immigration. This will lead to a new Golden Age for America in the 2020’s, which I believe will be a repeat of the 1950’s. Japan, Russia, and Europe suffer from a diabolical demographic outlook. China doesn’t look so hot either, thanks to its “One Child” policy. They’re just not making young people anymore.

Since I am also an old and grizzled Marine combat veteran and stay well connected with the military establishment, let me tell you a few harsh realities. Our military technology is the most advanced in human history, unbeatable, deeply feared, and is improving at breakneck speed. The American soldier is the best trained and most lethal ever deployed into the field. Did you know that no Air Force fighter pilot has been shot down in 20 years, despite being almost continuously at war during this entire time? The next generation of US fighters won’t even have pilots, with drones carrying much of the heavy lifting in today’s combat.

The US now provides for the active defense for about half of the landmass of the world; double that protected by the British Empire at its 1914 peak. Two decades after the end of the Cold War, the United States has no enemies of any real consequence. According to the CIA chief, General David Petraeus, Al Qaida has been worn down to a mere 200 active members. The futility of their efforts, confining explosives to shoes and underwear, show how badly things have gone for them.

We have been doing this with ever declining amounts of money. The military share of US GDP has plunged from 50% in 1943 to 6% at the end of the Cold War in 1992 to 4.7% today. It is about to fall off a cliff. Our defense budget is about to drop by half, back to pre 9/11 levels, either through budget cuts or sequestration. The Joint Chiefs are already prepared for this. Cyber warfare and drones are much cheaper than carrier groups and advanced fighters. If we spend less on weapons, the rest of the world will too. In a year, expect to start hearing about this a lot on your dinnertime news.

What about China, you may ask? They have had the blueprints of our most advanced defensive systems for many years now. But having a picture of a weapon is a long way from building one. They lack the technical expertise and the machinery even to copy what we already have. In any case, everyone knows China is indefensible. Torpedo one foreign grain ship, and the country will be starving in six months. China will never pose a threat as long as they can’t live without us and we have all of their money.

Yes, I know that it is an election year. It is up to the party that is out of power to portray conditions here as badly as possible so they can get elected to fix them. The party in power has to convince us how much things have improved so we can stay the course. The misinformation and apples versus oranges comparisons that get doled out as a result can make life complicated, frustrating, and difficult for traders and investors.

The next time I hear we have the world’s highest tax rate I am going to scream! I moved a company here from Europe 20 years ago because the actual taxes paid are low to non-existent. Just ask General Electric (GE), which pays a 3% tax rate. But hey, if this was easy, it would pay minimum wage, not ten figures, so I’ll take things as they are.

And the next time someone tells you that the US is history, consider that person a great short. It is they who are headed for the dustbin.

________________

For further information, visit our website or call us at 1-800-567-3115, 480-513-1830